“The value is always in the eye of the beholder. What is worthless to one person may be very important to someone else.” - Peter Ackroyd

There are plenty of definitions of value on the internet. But each is nuanced, which has led to differences in understanding of value. I make this statement because what I’ve reviewed in the literature, what I have read online, and what I hear in general discussions are always a little different.

In the above article, where I took a more academic approach, it became clear that I found value was largely subjective instead of tying value to an objective and measurable definition.

“public value is what the public values” - Talbot, C. (2006)1

It's almost a circular argument, but it indicates that value is inherently subjective and can only be measured once an individual has subjectively come up with that value. When you look at definitions provided by online sources or dictionaries, you get

“The regard that something is held to deserve; the importance, worth, or usefulness of something”2

“A fair return or equivalent in goods, services, or money for something exchanged”3

These also have elements of subjective measurement but also tie them to a measurable thing like money or a form of exchange. You may think that this may be overly critical and unnecessary, but in reality, a lot of the discourse that I currently see in public on Bitcoin and its value can be boiled down to this nuance.

Intrinsic Value

Something we always hear in Bitcoin is that Bitcoin, unlike gold, doesn’t have intrinsic value. So what is that

“In finance, the intrinsic value of an asset or security is its value as calculated with regard to an inherent, objective measure. A distinction, is re the asset's price, which is determined relative to other similar assets.”4

If we break down the above, there are two key elements here

Intrinsic value only looks at the objective measure.

Ignores price because it’s relative and not absolute.

Four perspectives make up those statements are

Objective: not influenced by personal feelings or opinions when considering and representing facts.

Subjective: based on personal opinions and feelings rather than on objectivity.

Absolute: describes something independently.

Relative: is dependent on others for a comparison.

If we put that into a table to see how these combinations align, we see that.

I found this view in an article published by Oregon State University. Since the author wasn’t attached, I'm providing the link to the article. While the linked article gives you examples of how these 4 categories manifest, I’ll provide my interpretation of money and Bitcoin as it is more relevant to you.

Objective & Absolute

This is where i believe the intrinsic value approach comes in. It requires that there are objective measurements of an items value and is absolute regardless of the situation/setting that its observed in.

In this case, gold is seen as having industrial utility, preserving wealth, being used in jewellery, etc. There is a hole in this logic, but I’ll hold that punchline for the end of this article.

Objective & Relative

Similar to above we are still using objective measurements but now we can add relative context to this.

Gold is an objectively valuable commodity; however, when compared to other valuable items in different situations, we get different value outcomes. In the West when compared to food, gold will be greater in value per gram given foods abundance. In communities cut off from the rest of the world like the untouched tribes of the Amazon, the value of gold against food will likely be far less when compared to the West. While the objective measures are the same, the situation dictates which is more valuable to an individual given the circumstances.

Subjective & Absolute

This one is where the value placed on the gold may differ from person to person; however, the fact that it is valuable is universally held regardless of who you are.

In the case of gold, the absolute element to this is that everyone would arrive at the conclusion that gold is valuable, however how much someone is willing to pay for it will change from person to person, region to region.

Subjective & Relative

This is where I stand on determining something’s value. I usually don’t like being contained in any box, and I found myself in the same position while in my PhD. I don’t like that i need to decide on either being Objective or Subjective but rather that it can be a mix where you can bring the two together to understand the whole better. I align with this quadrant because even in the face of objective measures, people can ultimately consider that and still make a subjective call on determining value.

However, the one that I am willing to align with is that value is relative and not absolute. In this case, it talks about a philosophy that i follow, which is

“The only constant in life is change” - Heraclitus 6th-5th century BC

To be absolute in your thinking closes you to the possibility of change. In the case of gold and money, that statement is true, and all it takes is an increase in the time horizon you are looking at.

You could say that gold has been the best money for the last 2000 years of human history. However, if you zoom out to 100,000 years, there was a time when gold was meaningless, and food and shelter were better given the need to survive.

Subjective Measures in Finance

To build on the above and the blend of subjective and objective measures to make up the whole value picture. Our current world is based on a blended objective and subjective value system, which gives a bit more weight to my stance. There is a term for when the objective measures cannot quantify the value of something completely. They include.

Consumer surplus

Goodwill

Intangible assets

The above in accounting standards and finance refers to identifiable things with a subjective value attached. Although there is a framework for approaching their valuation, it is ultimately a subjective call.

The same can be said of gold and Bitcoin. In this case, there is value in both. The question is whether these two assets' relative scales are absolute or variable. In the same way that food 100,000 years ago was more valuable than gold, Bitcoin in the digital age of the 21st century is looking to be more valuable than gold. It's a relative comparison as both hold value, but given the digital society we are transitioning into, these relative scales are shifting.

Making this practical

For those Bitcoiners who get stuck in our debates about the current financial system, you may want to think about it this way.

Know that the resistance from these people comes from a place of objective and absolutism.

Know that those we are debating have ingrained assumptions about what money is that wont be easily broken.

We come from a mix of Objective & Subjective measures and relative position.

Because we often talk about everything in terms of money when thinking about Bitcoin, everyone automatically ties the definitions of value and, in this case, emphasises intrinsic value to the discussion. We will hear that because Bitcoin doesn’t have cashflows, it doesn’t have intrinsic value. Because Bitcoin isn’t tangible in the physical sense and doesn’t have similar physical applications to gold, it is often dismissed as having no value at all. The mashing of these two arguments to demonstrate Bitcoin’s lack of value is intellectually lazy and puts me offside sometimes.

The above constrains the debate to a small subset of what value is. This is like saying that the fastest car in the world, the Koenigsegg Jesko Absolut, is the fastest way to get from Melbourne to Perth when it's actually to take a flight. In that example, it narrowed your lens of transportation to just automotive and completely disregarded air travel. The same is true with intrinsic value and value more broadly. Our good friend in the gold space, Peter Schiff, loves to do this, and the history books will look back on him as incredibly lazy or knowingly deceptive in how he is currently approaching his attacks on the Bitcoin space.

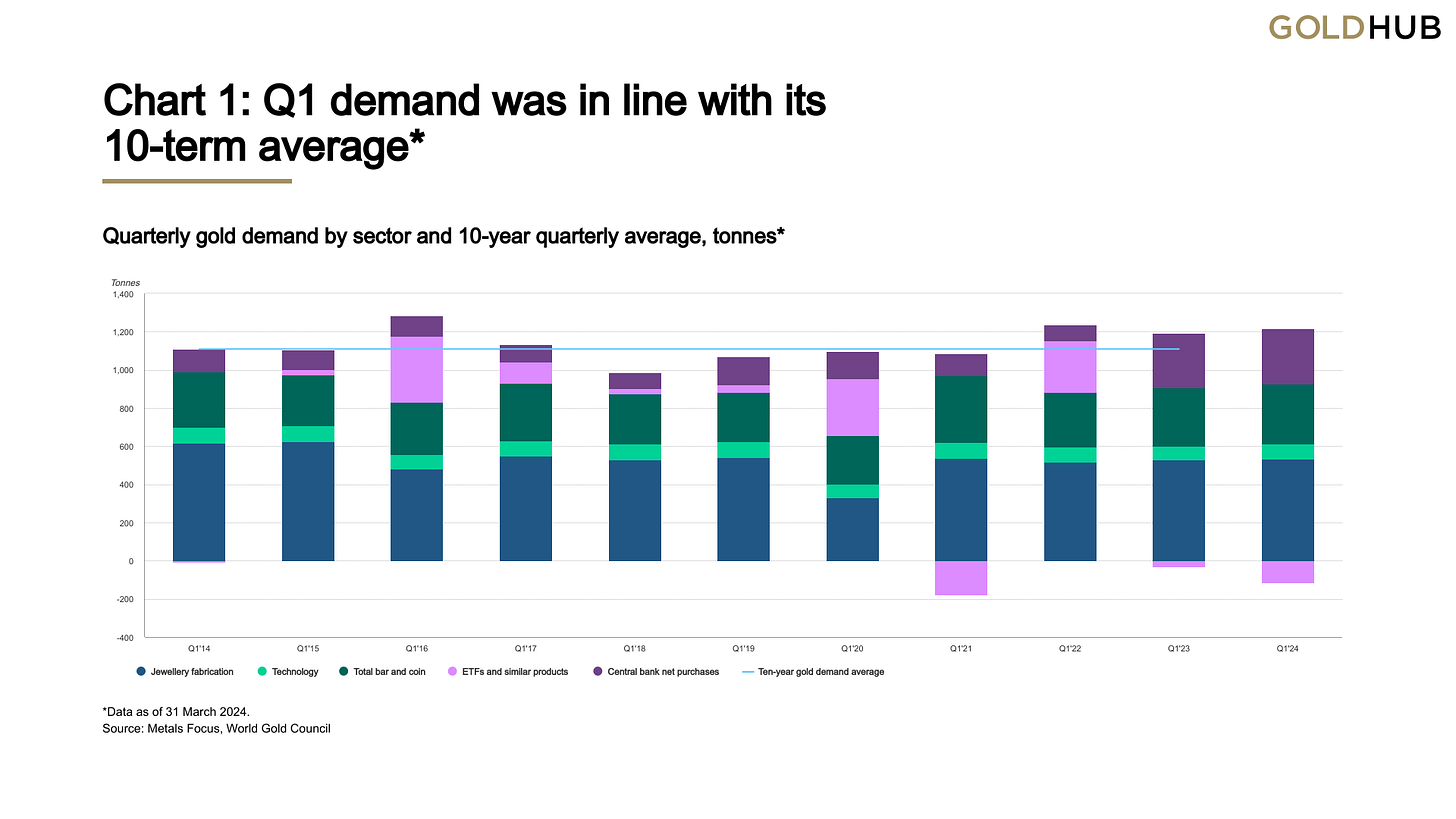

And for the nail in Gold's coffin that I alluded to above, the flaw in the intrinsic value logic. Below is a chart from the World Gold Council5

This chart breaks down the demand sources for gold below, but not all are intrinsic.

Jewellery - While work goes into crafting these pieces, the value of jewellery is subjective. Otherwise, 10 grams of gold dust would be worth the same as a ring of 10 grams of gold.

Technology - Gold has intrinsic properties that allow it to be used in specific technologies. You could argue that this has intrinsic value because the technology itself that requires gold will produce that intrinsic value.

Bar and coin - Gold in this form is just a set weight and/or shape of a substance that has intrinsic physical properties. But on any day, the global situation will change and will shift the price of this as a result. Nothing changed with the properties of gold, just our subjective views of the world.

ETF’s and similar products - There are no cashflows from this and the price is purely based on supply and demand, with demand being subjective and relatively driven by market forces

Central bank net purchases - Sames as the ETFs

Everything above is supply- and demand-driven; demand is inherently subjective and relative. The only difference between Bitcoin and gold is that one is physical, and one is digital. And the writings on this that I have seen largely align with this as well

Investopedia - Talks to gold being a mix of objective and subjective value6

Morning Star UK - gold has no fundamental value7

Atkinsons Bullion - states that gold has intrinsic value but lists aesthetics (which is subjective) as one source of value8

BP Trends - Similar to Atkinsons talks to it having intrinsic value but then uses aesthetics as a source of value9

That was to show a few. While some elements of gold's value may result from its intrinsic value (which is highly debatable), its total value is not.

Given the above, I’ll leave you with how I would position Bitcoin in this value debate.

Bitcoin has no cash flow and, therefore, no intrinsic value

Gold doesn’t either, and it is valued in the financial world.

Gold has intrinsic value.

Gold doesn’t have intrinsic value. It has intrinsic properties that people find subjectively valuable.

Gold is physical, and Bitcoin is not and therefore not valuable

Gold's building blocks are protons, neutrons and electrons. Bitcoins building blocks at 1’s and 0’s. To say that this isn’t valuable is to say that the internet and software also have no value.

Conclusion

I went on a little tangent above around gold vs Bitcoin, but hope you found that valuable and practical.

To cut this long story short, in my research moving forward, I will always start with the view that value is what the public values. This view forces me to think not only about traditional value measures like money or physical utility but also much more broadly into areas of psychology and new digital paradigms that will ultimately allow me to see the bigger picture. In other words, I won’t be constrained to a single train of thought on value, ultimately leaving much value unexplored.

This is a great example of how academic literature has done an incredible job of exploring a subject and providing incredible insights. Yet, these insights haven’t been translated into the public sphere effectively. I’ll quote my previous PhD superior: “We stand on the shoulders of giants,” and that quote couldn’t be more true in this case.

This subjective view of value will also be important when considering my third and final pillar, technology adoption. So you will soon see how these two things come together to provide the whole story of how to scale Bitcoin beyond money.

If you’re enjoying these articles, it would be great if you subscribed to the below and liked this post. And as always, see you in the next one.

Talbot, C. (2006). Paradoxes and prospects of ‘public value’. Public Money & Management, 31(1), 27-34.

https://www.google.com/search?q=value&rlz=1C5CHFA_enAU1043AU1043&oq=value&gs_lcrp=EgZjaHJvbWUyEQgAEEUYORhDGLEDGIAEGIoFMgwIARAAGEMYgAQYigUyDAgCEAAYQxiABBiKBTIMCAMQABhDGIAEGIoFMgwIBBAAGEMYgAQYigUyBggFEEUYPDIGCAYQRRg8MgYIBxBFGDzSAQgxMzU3ajBqN6gCALACAA&sourceid=chrome&ie=UTF-8

https://www.merriam-webster.com/dictionary/value

https://en.wikipedia.org/wiki/Intrinsic_value_(finance)

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024

https://www.investopedia.com/articles/investing/071114/why-gold-has-always-had-value.asp

https://www.morningstar.co.uk/uk/news/120804/gold-has-no-intrinsic-value.aspx

https://atkinsonsbullion.com/news/july-2021/why-do-gold-and-silver-have-intrinsic-value

https://www.bptrends.com/why-gold-has-intrinsic-value-for-investors/

The key point from this article to those that have navigated to Thai article but don’t have the time to read it in full.

1. Value is subjective

2. Gold has intrinsic properties but not intrinsic value

3. Value is relative

4. There is intellectual laziness if how we publicly talk about value